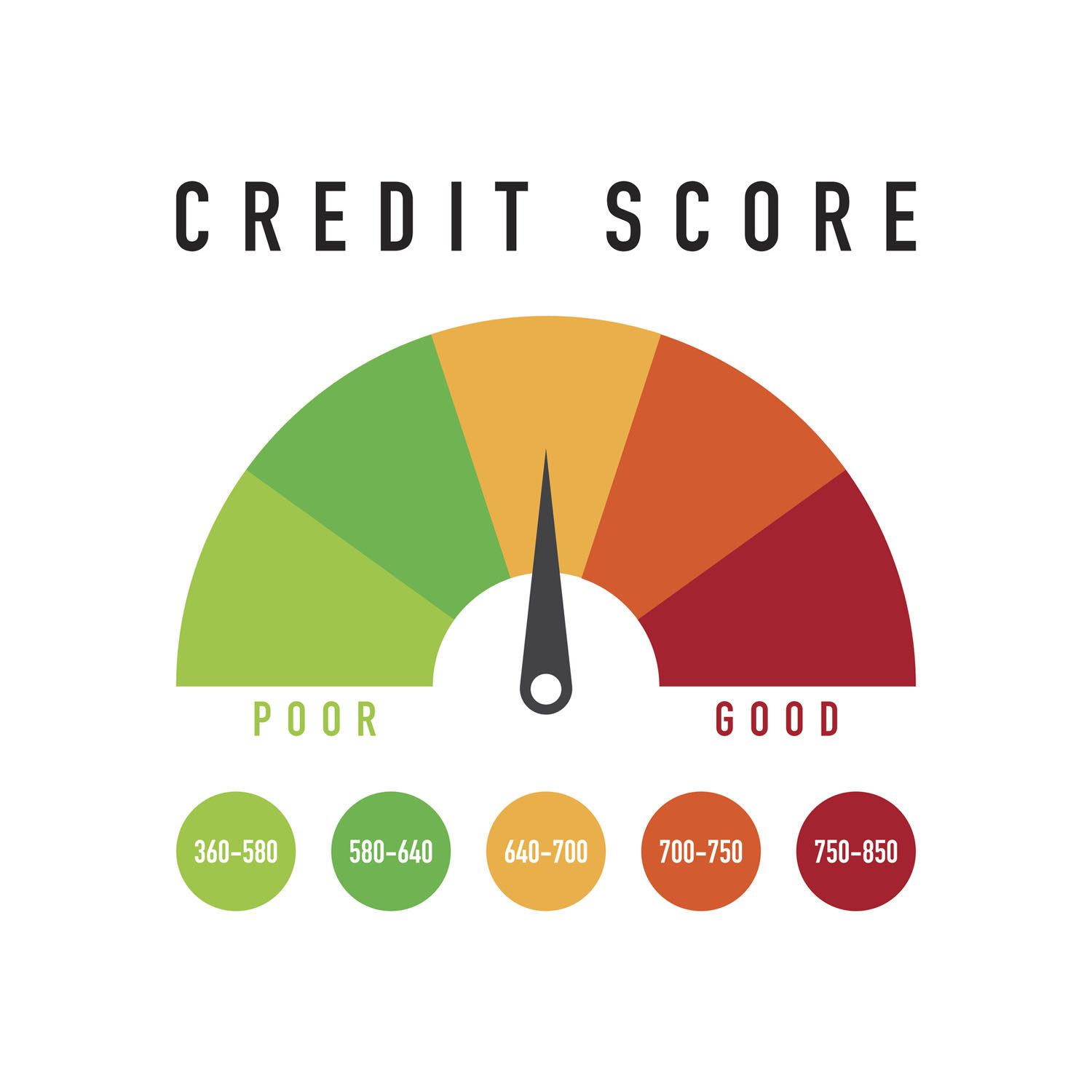

Credit scores run a significant part of the American economy, with their applications coming in handy in areas such as credit card applications and mortgage and car loans. With 30% of Americans having poor or bad credit, it means that a substantial portion of citizens are missing out on essential financing opportunities. But what happens when your only option of rebuilding your credit lies in borrowing, an aspect that is hindered by your poor score? The solution lies in lease-purchase programs. Read on to find out how this can be a handy tool for rebuilding credit.

Understanding Lease-Purchase and Its Benefits

Lease-purchase refers to a contract that allows a buyer and seller to get into a lease period, after which the tenant can purchase the given property. Your lease program reports the lease payments to credit bureaus during the lease duration, building your credit score in the process. The program, however, calls for timely payments, failure to which you accrue negative scores during your lease term. The lease program is designed for people with poor credit scores or those who lack any credit history, making it a worthwhile venture for numerous applicants.

Apart from rebuilding credit over time, lease-purchase also allows you to take care of essential property needs without causing a dent in your finances. Furnishing a home often calls for significant savings, an aspect that can be elusive if you are already struggling with poor credit. With lease-purchase, you can negotiate your lease arrangements based on your current financial capability, leaving you with enough room to pay for appliances on your terms.

Additional Tools to Help You Rebuild Your Credit

In addition to using lease programs for rebuilding credit, other options that you can utilize include the use of apps like Experian Boost and Credit Karma. Designed to help you improve your credit score, these will come in handy in revealing gaps in your credit reports that may be contributing to poor scores, with workable solutions on how to scale up.

Some recommendations from Credit Karma include opening other lines of credit with your credit cards. Multiple credit sources go a long way in boosting your score, with the most common being auto loans and mortgages. But even with this, remember to keep your new sources of credit limited to what you can afford, as delayed payments will only tarnish your credit. Where possible, make it a point to use automatic payments to ensure you stick to timely payments for positive payment history.

If you are looking for a way to rebuild your credit, consider looking into these for a better financial future.